This is how you go from surviving to thriving in your money. Start planning (and saving) early.

If you missed the week�s events, here are some steps you can take to increase your savings and build a foundation for future financial success:

How to plan for the future financially. Write down your financial goals. How to plan for future growth. How to plan for future growth.

How to make a financial plan. Financial security when it comes to retirement is a big thing, and a big change emotionally also. 1) know what you�re saving for.

In our adult lifetimes we have owned 11 homes in the united states and united kingdom. All those life expenses (graduate school, marriage, home ownership, retirement), they all cost a lot of money. A plan for your financial future wouldn’t be complete if it didn’t have a purpose.

Money management begins and ends with knowing how much cash is coming into and flowing out of your wallet. If you are currently at the stage in your life for retirement planning cheshire, you are probably taking some time to consider whether your pension meets your needs and how to plan for the future financially. My wife and i have been married more than 30 years, but we don’t have any kids.

This is how you go from surviving to thriving in your money management. It’s time to create a financial plan to pay off debt. When wondering how to plan for the future financially, always remember to spend less than you earn and pay down your debt.

It’s never too soon to start thinking about the future—especially your financial future. Calculate your net worth (your assets minus your liabilities) organize your expenses in order to understand your spending patterns. Being prepared for the future is as simple as saving money each month.

When it comes to planning for the future financially, there are many areas to explore. With the immediate financial musts taken care of, it’s time to look farther forward into the future. Keep a separate savings account for your future and dedicate a percentage of your income each month to this savings account.

Our professional and qualified financial advisors are equipped with extensive market knowledge and experience to help you plan for your future without breaking the bank. An evaluation of your current finances will help you plan for what you will need in the future. So just a rough idea, and then a plan to save for that plan, if needed.

After all, you have to know what you want to. When planning out your retirement, it is easy to overlook the. When you set goals, plan, and invest appropriately — we believe the return can be well worth the necessary investment.

“financial planning takes into account not only what you need to run your business today but also what you will need to move your business forward in the future,” assures courtney hopper, founder of hustle + gather. While the global economy is still recovering in some ways, the stock market is performing well. If you would like to book a free 30 minute initial chat, please click the button below, or contact tony thomas on 07585 592494 or tony@wealthmasters.co.uk.

With the immediate financial musts taken care of, it’s time to look farther forward into the future. Will you move closer to family or stay where you are? The needs of two people will never be the same when it comes to planning for the future.

Just leave a missed call on indianmoney.com financial education helpline 02261816111 or just post a request on indianmoney.com website. Along with a budget, one has to plan one’s lifestyle as it can have a major impact on your financial planning. You shouldn’t borrow to fund a lifestyle.

It can be hard to have a definite plan this early of course. Consequently, you’ll want to set aside some objectives. If you missed the week�s events, here are some steps you can take to increase your savings and build a foundation for future financial success:

You must try to balance between the income and expenses every month so that you save a certain amount. Want to know how to plan for the future financially? How to plan for the future financially future plan ielts speaking part 2 cue card with answer ielts exam 1 comment / academic speaking , general speaking / by ielts fever / 01/05/2017 17/02/2018

This is how you go from surviving to thriving in your money. This means when you are planning for the future, you should never follow others. How to financially prepare for the future.

As soon as you’re able, it’s smart to start saving as. Planning for the future financially is absolutely imperative if you want to see yourself and your family through a crisis. Write down short and long term goals to achieve your imagined future, and track your progress in a journal.

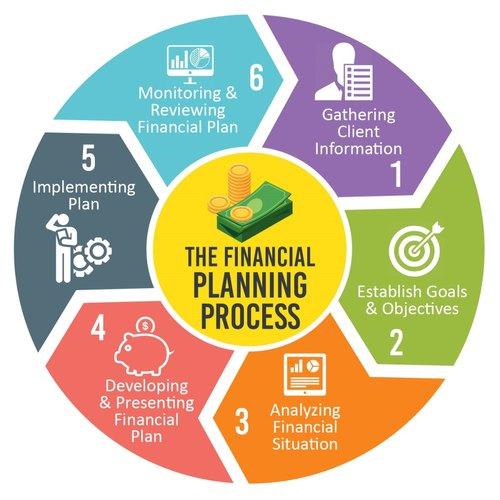

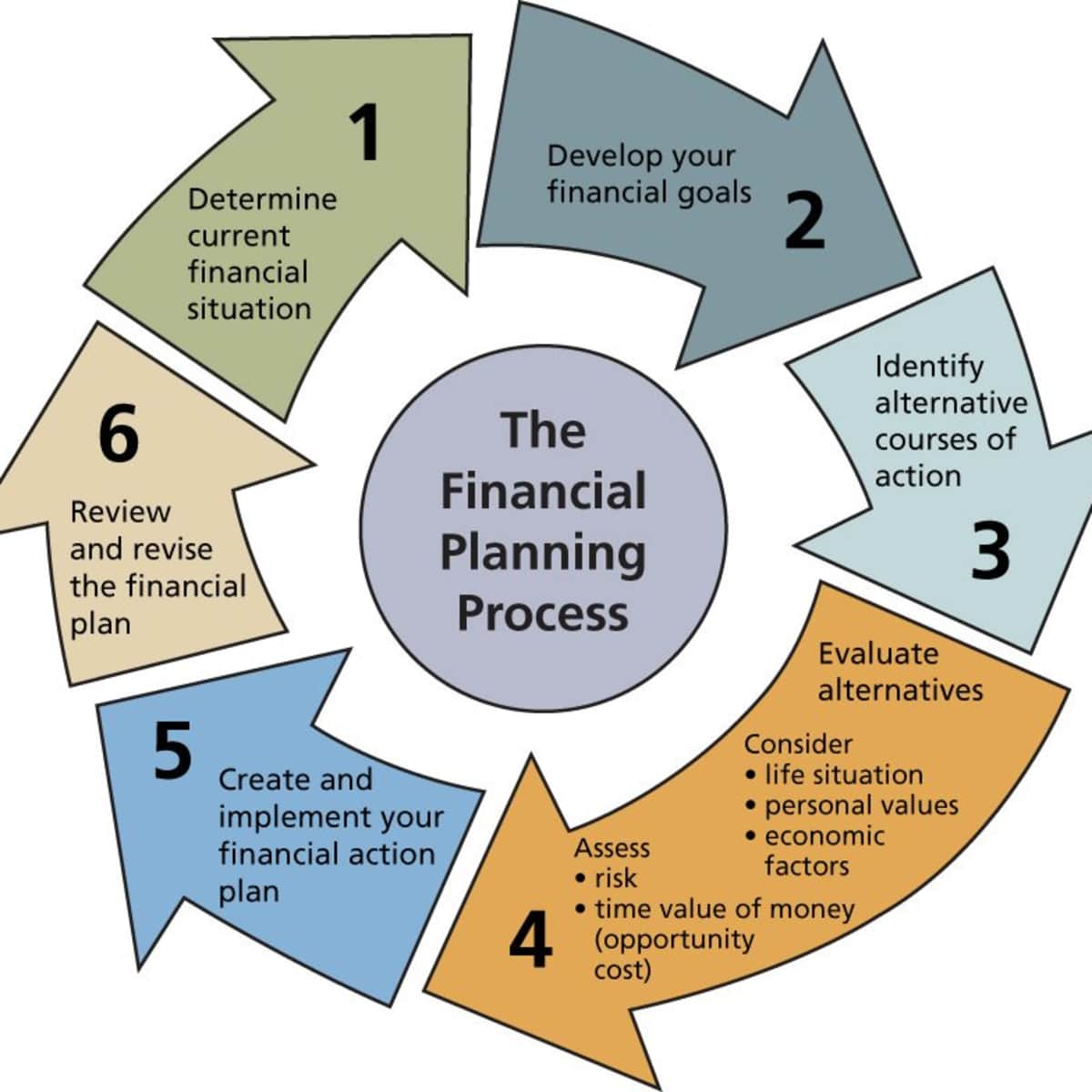

Start planning (and saving) early. Below, you’ll find ten steps to create a solid financial plan. To plan for a successful future, identify what you’re passionate about, what comes naturally to you, or what your favorite hobbies or experiences are.

There are 2 main methods that are widely recommended: Having financial goals is the foundation for your financial success. Becoming financially independent starts with:

Remember, this account isn’t for fun spending or anything frivolous; If you can’t afford it, then. Next, use these things to help you decide on a future career path.

There is a wide array of wealth and financial investment plans for everyone. Here are 5 ways to plan for your financial future: One of the best ways to make sure that you are financially set for the future is my only borrowing for investments.

Examine your retirement and other investments.