Top dollar’s free debt payoff worksheet. Debt snowball worksheets from funding cloud nine.

And combines all the numbers and.

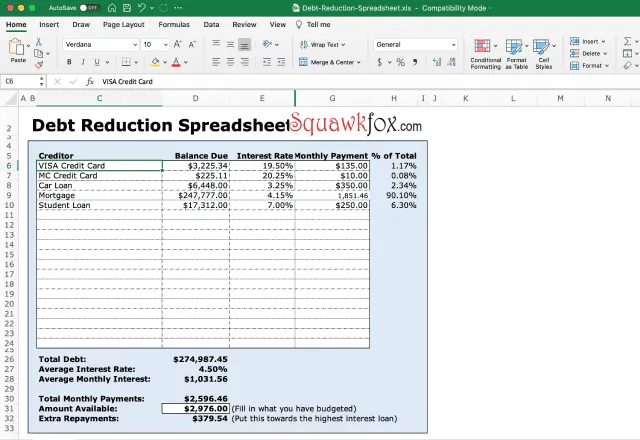

Get out of debt plan spreadsheet. The debt snowball calculator is a simple spreadsheet available for microsoft excel® and google sheets that helps you come up with a plan. Getting started can be daunting, however. If you feel overwhelmed by your debt, are only.

Download the free debt snowball spreadsheet ( here’s the link again in case you missed it earlier ) and be sure to report back to us about your success with paying off your debt. Free get out of debt spreadsheet, get out of debt budget worksheet, get out of debt plan spreadsheet, get out of debt excel spreadsheet, free get out of debt in our spreadsheet use the changes column to make all the adjustments you think you can achieve. 6 using your debt snowball spreadsheet to pay off your debts.

If you’re planning to pay off your debt using this method, you’ll start with your smallest debt. Track your debt payoff with this free debt tracker spreadsheet in excel format that is easy to use and customize to help accelarate your debt payoff. You’ll probably want to assemble them in a small binder and fill them out each month as you make your debt payments.

Get out of debt plan spreadsheet for everyone excel accounting template free templates business I love the design and i�m so excited to pay off my debt. The debt snowball spreadsheet is a super useful tool if you want to get out of debt using the debt snowball method.

Top dollar’s free debt payoff worksheet. Getting out of debt is not as difficult as most people think. It will help you complete the ‘get out of debt’ formula:

Whether you are looking to get out of debt, or stay out of debt, a good approach to budgeting can help. It will also help you learn how to trim your spending so that you have the money to set aside in savings for short term goals and long term plans. Using the budget calculator spreadsheet will help you identify the different types of expenses that you need to plan for, and how much to save for each.

This is one of the most efficient and simple ways to take care of debts. Get more organized and create a simple debt repayment plan. The debt snowball spreadsheet is simply an excel spreadsheet that’s made for someone to enter their debts from smallest to largest, and then show them how long it will take to pay the debt off!

Debt snowball worksheets from funding cloud nine. You find more confidence in your debt payoff plan. Download the free printable debt payoff worksheet here.

If you’re committed to getting out of debt and you were looking for a free debt reduction spreadsheet, i hope you could this one immediately. If it’s going to take one year, you can see it and track it on your chart. Debt snowball makes the work easy for you by displaying the whole picture in one sheet.

This is a great approach. Repeat this method as you plow your way through debt. I like that this spreadsheet is a complete financial toolkit and not just about paying off debt.

Get your spouse on board with the debt payoff plan and more involved with your finances by sharing the spreadsheet. Print a debt payoff tracker worksheet for each debt that you have. There are many ways to eliminate your debt and having a good spreadsheet to track the progress is a very valuable tool.

Once that debt is gone, take its payment and apply it to the next smallest debt while continuing to make minimum payments on the rest. My goal is to get out of debt within the next 8 months. Here at hoyes, michalos we recommend two different approaches to budget your way to a debt free life.

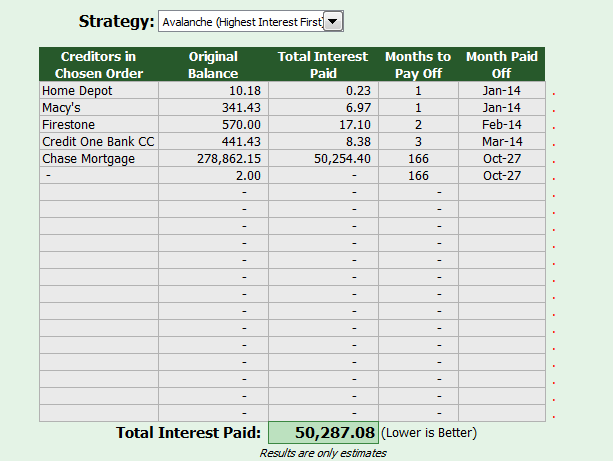

A debt payoff plan includes figuring out what debt you have to pay, in what order you need to pay them, and how much you need to pay to eliminate them. If it’s going to take three years, at least you know that going in and can prepare yourself mentally for the long journey ahead. Debt snowball spreadsheet is the best solution to overcome the debt problem.

I have previously written about the first step to get out of debt,. Simply enter basic information about each of your debts, including the starting balance, current balance, interest rate, and minimum payment. But you need to find the right budgeting method that works for you.

It takes away the abstractness of personal debt. Once you click on the � give me my free spreadsheet� button, you will get an email from me confirming you want the spreadsheet. A debt and budget spreadsheet, along with a debt payoff calculator, are a great way to keep your get out of debt journey in context.

By creating this plan and following these steps, you will create a plan that is not only realistic to your lifestyle, but one that will fit within your personal budget as well. If you want a plan to get out of debt, this is the spreadsheet to use. The first is our free excel budget spreadsheet.

Received the spreadsheet right after my purchase. Calculate which debt payoff method is best for you and/or will save you the most money. Spreadsheet october 14, 2021 17:00.

I have student loans and medical bills im trying to pay off. You can get it for free by simply entering your email address below. The debt payoff spreadsheet will help you:

Get out of debt spreadsheet. There is a debt priority worksheet to help you figure out which. Then it can feel like your budget is off track as you try to get out of debt.

The fastest way to get out of debt Received the spreadsheet right after my purchase. If this question has been holding you back from getting serious about paying off debt, the debt payoff tracker worksheet is your perfect starting point.

Then you’ll gradually move to the bigger ones. And combines all the numbers and. Download your copy of the worksheet here to estimate how much money to put toward your debt each month and how long it will take to pay off.

Fill it out every time you make a payment to see your progress! A lot of people swear by this method because it’s extremely effective.